Manufacturing’s Good News Day

While the “hard” data banged down the doors, we still expected a little lift from the softer manufacturing figures. Guess what? Both surveys decided to play nice and everyone got a pleasant surprise.

Key Takeaways

- S&P Global Manufacturing PMI jumped from 52.0 to 52.9 in June – higher than the 52.0 forecast and the best reading in over three years.

- ISM Manufacturing Report nudged up from 48.5 to 49.0 – surpassing the 48.8 expectation and marking the highest level since February 2025.

For a change, the two big indexes were on the same page, offering a brighter glimpse into the state of the manufacturing sector.

Tariffs, Prices, and the Wild Ride of the Octennial Economy

Imagine a world where every purchase feels like a small gamble. That’s what tariffs are doing—shaking up the way businesses decide to buy and what people ultimately pay.

Manufacturers’ Rush to Build Safety Nets

- Input buying activity hit a high level that hasn’t popped up since April 2022. They’re stocking up like squirrels preparing for winter.

- Why? Because trade rules are confusing, and prices are doing the tango—one move here, one step there.

The Inflation Holiday is Still on

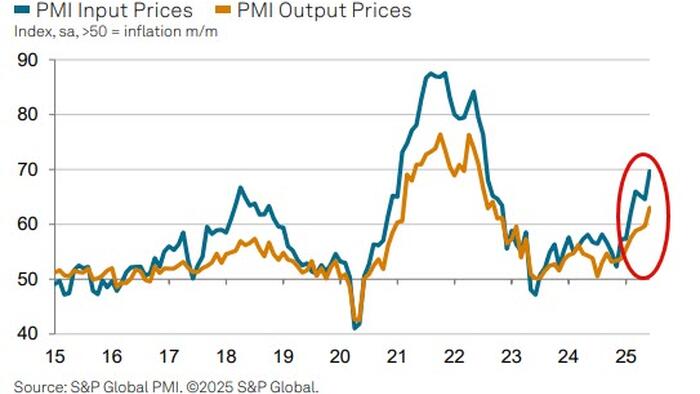

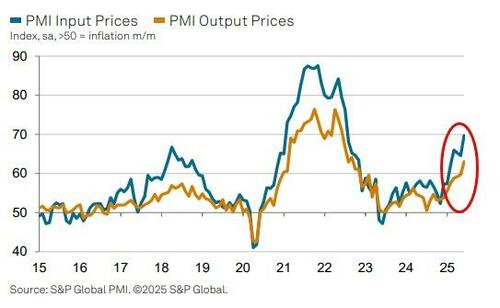

- Input costs spiked, keeping inflation at its highest point in almost three years.

- Meanwhile, output charges climbed to a new peak since September 2022.

ISM’s Sigh: Employment and Orders in a Down‑Trend

- Both employment and new orders dipped below 50, the contraction zone, and flopped a bit harder in June.

- It’s a bit like watching your favorite sports team miss the playoffs—disappointing, but maybe a golden chance for a comeback.

So there you have it: tariffs still on the mix, costs climbing, and the market feeling the itch of uncertainty. Whether you’re a business owner or a shopper, it’s a rollercoaster you’ll likely want a front‑row seat to.

Manufacturing Gets a Pick‑Me‑Up, but Inflation’s on the Horizon

June flipped the script for U.S. manufacturing: after three flat months, production finally swung back to growth. According to Chris Williamson, S&P Global’s Chief Business Economist, the boost comes from a combo of higher order volumes—both at home and abroad—plus factories scrambling to keep up.

The Workforce Effect

- More labour now than we’ve seen since September 2022—because the uptick in demand forces manufacturers to stretch their crews.

- Workloads are rising: orders are pouring in from retailers and wholesalers, spurring plants to hire faster.

Why the Growth Might Not Stay

But here’s the kicker: a portion of the surge is a buffer‑building strategy. In a climate of tariff‑driven price hikes and looming supply snags, factories and their retail/wholesale clients are stacking inventory to stay ahead.

- This “inventory built‑up” might be a double‑edge sword. By storing more goods, manufacturers can sweet‑en the deal now, but it might also slow things down once the buffer runs low.

Inflation’s Red‑Flag

Fast‑forward to the second half of the year: the pay‑back could look like a deceleration of growth because the inventory strategy is running its course.

Even more pressing, price pressures are stacking up. June saw factories report steep cost jumps tied to tariffs. They’re bankroll these expenses onto customers, potentially nudging consumer prices higher.

- Will this be a temporary bumper in price levels, or a sign of a more persistent “stubborn inflation” saga?

Time will tell. For now, manufacturers are riding the growth wave, but the lingering question is whether the bright side is truly that bright.

Business Confidence: From Low‑Tide to Sunny Skies?

Picture this: April’s markets were in a slump, but lately, the vibes are shifting toward sunshine. American manufacturers are suddenly feeling fresher and lighter on their trade and tariff worries—like a breeze after a storm.

What’s Changing?

- Lower uncertainty: The gnawing fear that gripped April is drying up.

- Optimistic shout‑outs: Factories are saying “Let’s do this!” more often than “We’re stuck.”

- Still on tip‑toe: Many firms are still walking carefully because the final sign‑off on paused tariffs is inching closer.

Why the Delay?

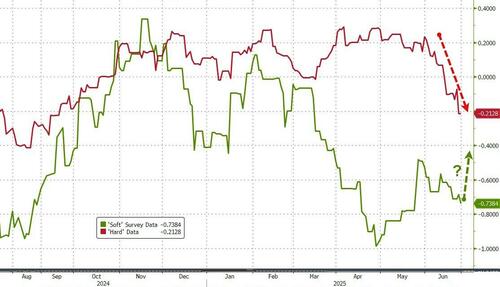

The countdown to the trade‑deal deadline left companies scratching heads—will the “soft” data surge or continue to flop?

Soft Data: The Rumors

Rumpled but hopeful:

- “If the trade talks slam the brakes, we might see a rebound in the soft economic indicators.”

- “Trade decisions could either catapult confidence or keep it stuck.”

Bottom line? While manufacturers are taking a breath of fresh optimism, the whole business world is waiting in the wings—hopeful, yet cautious—at every new piece of trade gossip. Will that sweet soft data finally get its juice? Time will spill the beans.

Please share the article you’d like me to rewrite, and I’ll get started right away!

Please share the article you’d like me to rewrite, and I’ll get started right away!